It’s that time of year again to complete your annual tax return for the Australian Taxation Office.

The Australian income year starts on 1 July and ends on 30 June the following year.

The annual tax return details all your income for the year and enables the government to calculate if you’ve paid enough or too much tax.

Paid too much? – you’ll get a refund.

Paid too little? – you’ll get a bill.

One way to maximise the chances of a refund is to ensure that you let the Tax Office know of all the legitimate work-related expense that you have incurred over the year.

In Australia, tax is generally withheld from your pay as you earn it each week or fortnight and you may need to lodge a tax return each year.

It’s no different for overseas visitors who have worked in Australia and paid tax throughout the year.

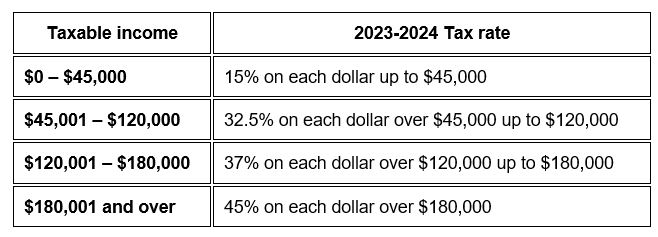

417 and 462 Working Holiday visa holders pay 15% tax from the very first dollar earned for the first $45,000.

Higher rates of tax will apply above this threshold.

For more information, see tax table for working holiday makers.

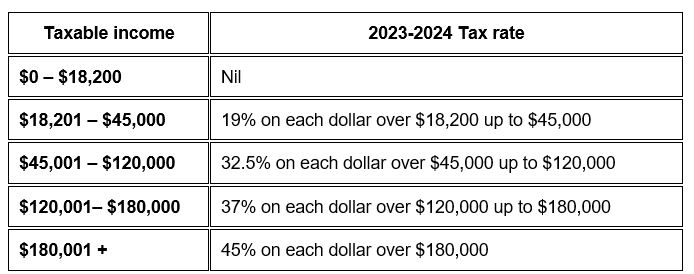

If you are an Australian resident or hold most other visas, then you don’t pay any taxes if your annual income is below $18,200, however over and above that figure, the following tax rates apply:

For more information, go to ato.gov.au/occupations or make an appointment with a registered tax agent or accountant to help you.

And yes, the costs of engaging a professional to help you complete your tax return is a claimable expense.