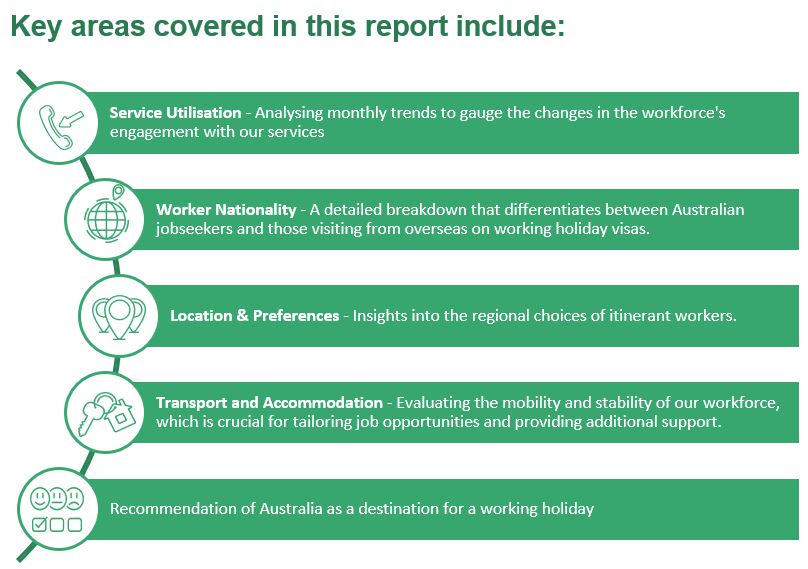

The Harvest Trail Information Service (HTIS) records and analyses data regarding itinerant workers who engage with us, ensuring we cater effectively to their needs as part of our commitment to continually improve and adapt our services.

For the period spanning 1 October to 31 December, this report provides an analysis of the HTIS contact centre data, providing critical insights into the demographics, preferences, and logistical capabilities of the jobseekers who contacted us.

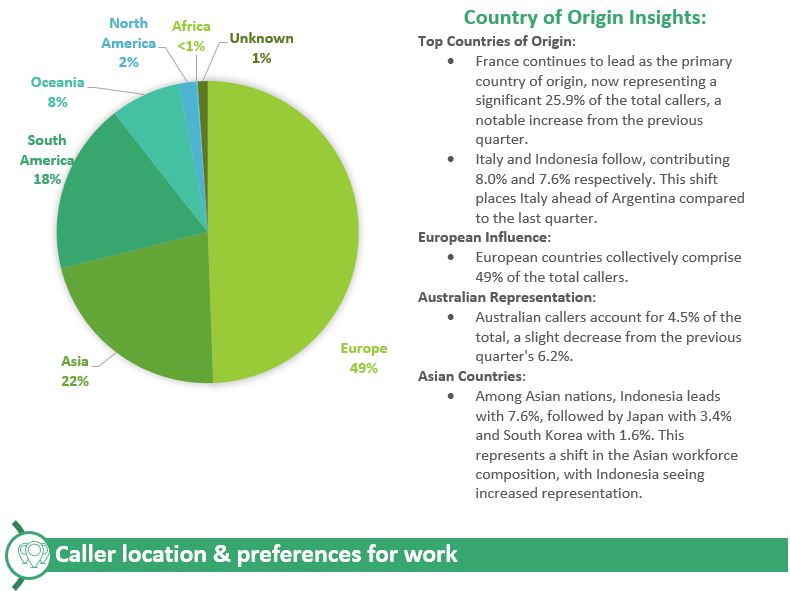

From understanding the nationalities of these workers, to discerning their location and job preferences, this report offers a panoramic view of the itinerant workforce landscape. Please note this data does not represent the calls received from regional Harvest Trail Service (HTS) providers or feedback from every contact made.

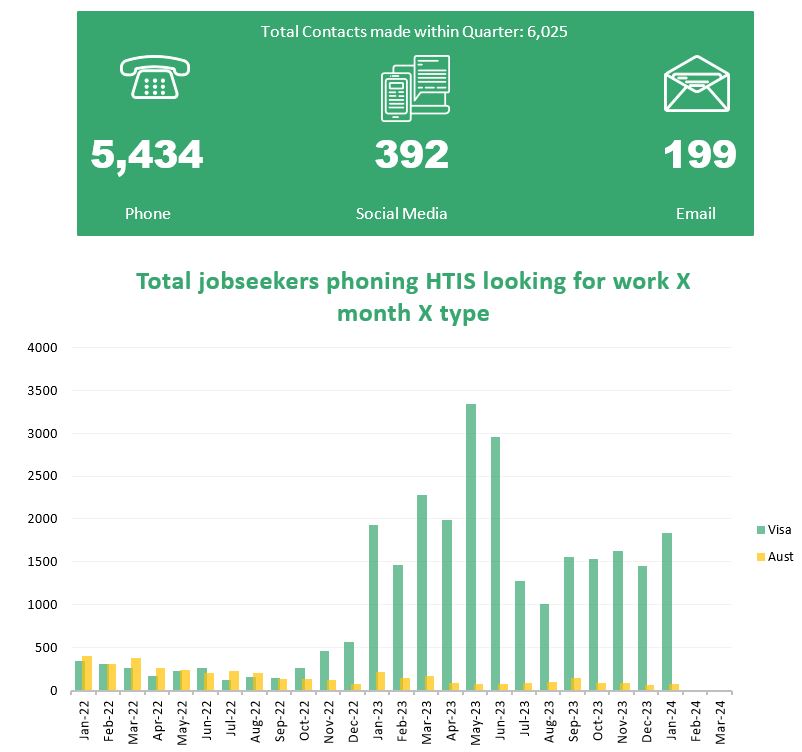

The October – December quarter is marked by a gradual increase in labour requirements across much of the country as a result of seasonal trends, which has a flow-on effect to jobs advertised on the Harvest Trail website, and subsequently the number of enquiries received by the Contact Centre.

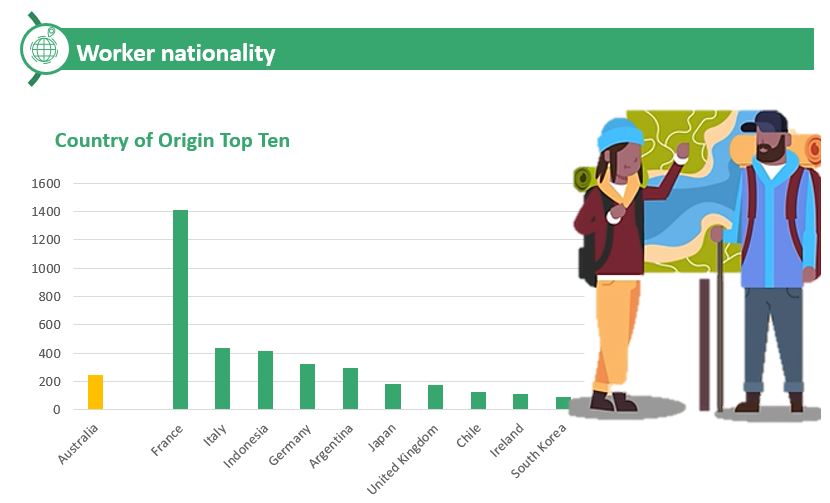

When viewed in the context of the broader labour dynamics in the horticulture industry, the recent data from our contact centre offers a nuanced understanding of the evolving labour landscape across Australia.

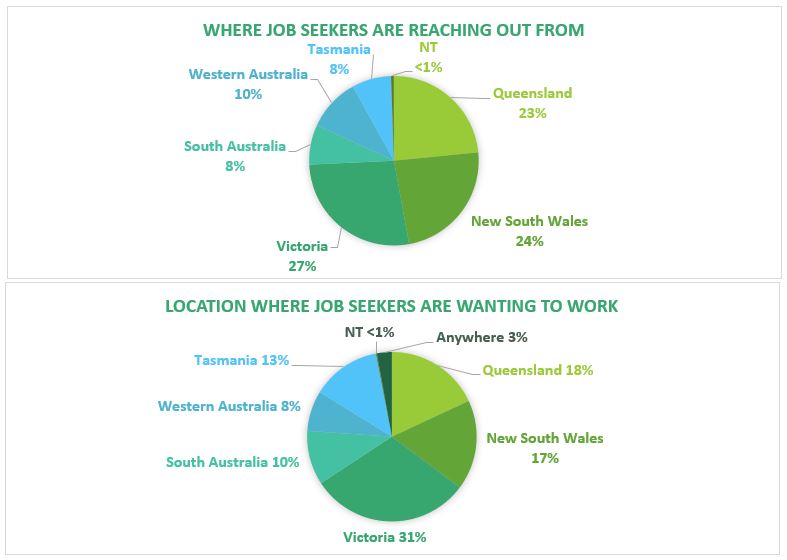

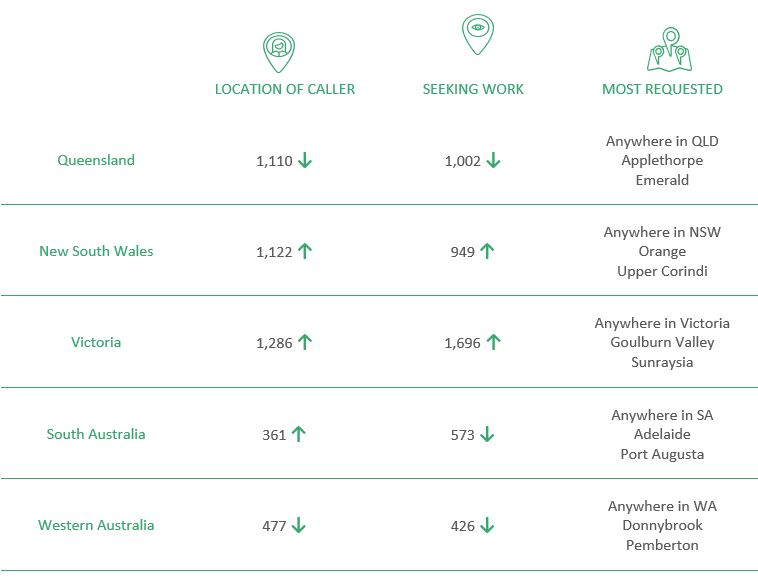

Victoria takes the lead, surpassing Queensland and New South Wales, accounting for a significant portion of the calls, indicative of its growing appeal as a preferred work location. This is supported by a strong quarter across various commodities due to favourable growing conditions resulting in a consistent demand for labour.

Queensland and New South Wales remain significant, but the oversupply of jobseekers, especially backpackers, might explain the high number of calls despite established workforces in these regions. The oversupply of labour in New South Wales and Queensland is reflected in the competitive behaviour and high availability of workers actively seeking vacancies.

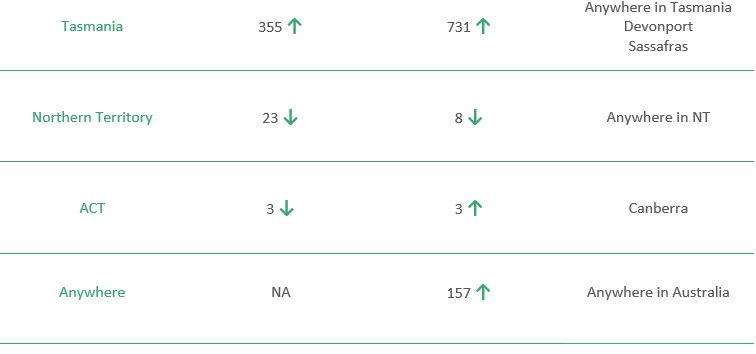

The rise in calls from Tasmania is likely linked to its earlier start to the season and a clean employment image, attracting more backpackers. This shift indicates a growing interest in the region as a desirable work destination.

Regional Specifics and Worker Behaviour:

- In New South Wales, the influx of workers, especially in areas like Young for the cherry season, and the competitive behaviour of backpackers to secure jobs have contributed to the high call numbers.

- In Queensland, the impact of Cyclone Jasper and subsequent shifts to recovery efforts have influenced labour needs and the pattern of calls.

- South Australia’s grain harvest dynamics, characterised by an oversupply of backpackers seeking work, align with the moderate call numbers from that state.

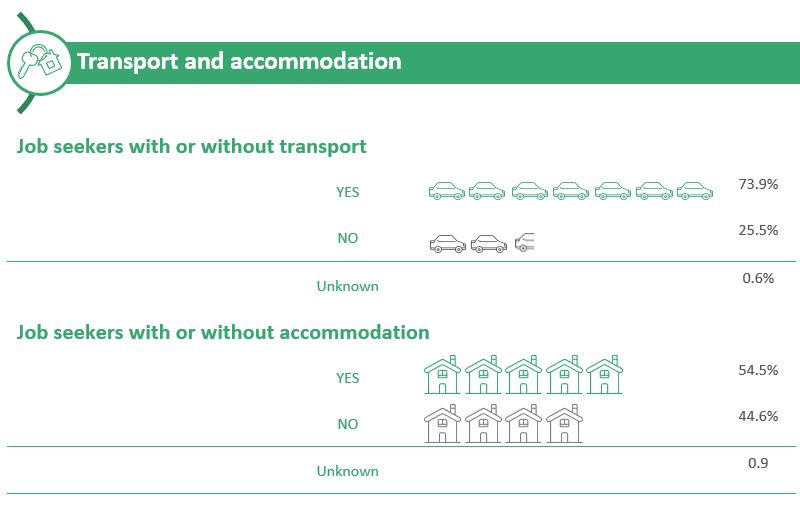

When looking at the trends in transportation and accommodation among our itinerant workforce, it is important to note the continuing expectations from employers. Many job vacancies still require workers to have their own transport and accommodation, a requirement that significantly influences the scope and flexibility of employment opportunities available to job seekers.

There has been an increase to 73.9% in workers having their own transport. This is a slight increase from the 71% in the previous quarter, indicating a continuing trend towards greater transport independence among workers.

The data shows a more balanced situation in terms of accommodation, with 54.5% having their own accommodation and 44.6% not having it. This is a significant change from the previous quarter, where 60.6% had no accommodation.

The increase in workers possessing their own transport and accommodation indicates a shift towards greater independence and flexibility in the itinerant workforce and a greater awareness of what is required to obtain employment in a very competitive market.

Overall, while Australia continues to be seen positively as a working holiday destination, there are indications of changing perceptions among the itinerant workforce.

The recommendation rate for Australia as a working holiday destination decreased from 89.8% in the previous quarter to 87.6% in the current quarter. This drop suggests a slight shift in the overall sentiment among workers.

There is an increase in respondents not recommending Australia, rising from 5.6% in the previous quarter to 12.0% in the current quarter. This increase indicates growing competition for available work leading to discontent among a portion of the workforce.

Several factors may have influenced the decline in recommendations for Australia as a working holiday destination. Insights from the Harvest Trail Service and Contact Centre suggest that an oversupply of labour, especially in Queensland and New South Wales, has intensified job competition. This increase in competition likely leads to more employment challenges and may lead to less favourable experiences for job seekers.

Additionally, adverse weather events like Cyclone Jasper in Queensland and the impact of rain on the Adelaide Hills’ cherry crops have disrupted work opportunities. These events have shortened work seasons and affected income stability, thereby contributing to a sense of uncertainty and negatively impacting perceptions of the working holiday experience in Australia.